Hello friends! Today’s post is going be different than the usual and it might even seem a little off topic because it’s about numbers (my favorite subject). As a financial analyst, budgeting is a subject near and dear to my heart and something I have been wanting to write about for a while now. While it doesn’t fit the usual cozy home posts of DIY projects and healthy recipes, it is something that is essential to the kind of lifestyle we write about. Sound budgeting not only reduces stress but it is absolutely necessary for eating healthy, saving for the future, and investing in quality experiences (just to name a few).

Although life is busy with two kids and endless responsibilities, I try to make sure that my wife and I are on the same page when it comes to our finances. While talking about money sometimes gets a bad rap in certain cultures (it can be taken for stinginess or greed) the reality is that money is an important aspect of life that, when managed properly, can be a real source of strength for your family. With the New Year just around the corner, I wanted to write a series of posts that would be helpful for those looking to review and improve their financial stability by acquainting them with some basic concepts, tools, and resources to budget better, save more, and stress less. In this first post, I will discuss a simple approach to budgeting that will involve choosing a methodology for budgeting and tracking that is comfortable and realistic for you and your lifestyle. Let’s get started!

Agenda

- Choose a methodology for budgeting that is realistic

- Find and maximize your budgeting strategy to free up time for other activities

- Help you commit to a new financial awareness

1. Cash vs. Credit: Choose a spending system

There are many blogs and websites out there that tout the merits of using cash-only while vilifying credit cards as enablers of mismanagement. While there is some truth to this, there are many benefits to using credit cards especially when used alongside online budgeting platforms. I am a firm believer of using a hybrid system and as of right now we have an 80/20 split between credit and cash respectively. Choosing a system is important because it will dictate how you track your numbers. For example, if you decide to use mostly credit like we do, along with an online budgeting platform, much of the work in terms of tracking numbers will be done for you automatically. Another benefit of using credit is being able to take advantage of cash-back or point bonus systems that many well-known credit card companies offer. While your budget will dictate to some extent what your spending system will look like, it’s important to envision how you’re comfortable spending so you can get into a rhythm that works for your lifestyle and fits into tracking and accountability.

2. Written vs. Digital: Tracking your numbers

Aside from choosing a spending system, it’s also important to pick your preference when it comes to keeping track of your income and expenses. There are many budgeting apps and free online software’s such as Mint, YNAB, Google Sheets, and Microsoft Excel to name a few. I use Excel because I always have but if I didn’t have access to it then Google Sheets would be a more than capable replacement. If you can’t see yourself committing to updating a sheet every day or two on the computer then stick to good old pen and paper (you can find PDF expense trackers here). If you’re not into tracking at all then you might want to really consider an online system like MINT or YNAB. All you need to sign up is a valid e-mail address and the rest is simply adding your financial account information. Mint is a free platform while YNAB is free for some people such as college students (more on their pricing structure here). The most important thing is that you choose a medium that is comfortable for you so that you can be consistent and disciplined.

Now that you have an idea of what kind of spending system you’d like and how you want to keep track of your numbers, let’s do a very basic run through of how to calculate a budget.

3. Fixed vs. Variable Expenses: Determining your Budget

Fixed expenses: A fixed expense is one that you can’t change and tends to stay around the same dollar amount every month. Mortgage payments, apartment rent, and car lease payments are all examples of fixed expenses.

Variable expenses: A variable expense is something that changes from month to month based on different factors. Groceries, clothing, entertainment, and gifts would be examples of variable expenses because you decide how much to spend to some degree.

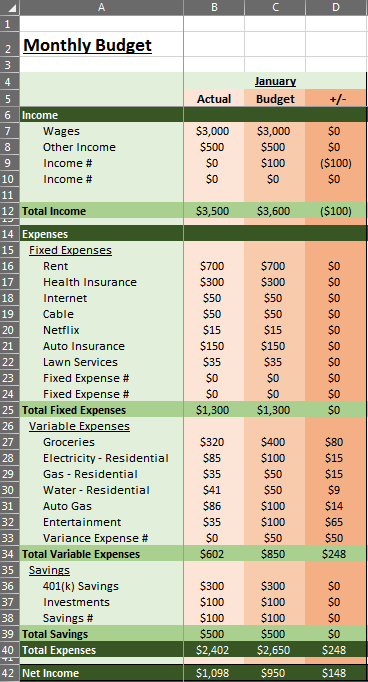

To determine your monthly budget, you will need to calculate your expenses (fixed + variable) and subtract them from your monthly income. I have provided a sample Excel sheet template below for downloading to show you how this is done. As you can see, there are three sections: income, fixed expenses, and variable expenses. If you want to follow along using the custom budget template that I created, go ahead and start by inputting your income first followed by your expenses. In this example, the income is $3500/month, total expenses are $2402, and there is a positive balance of $1098.

You can adjust the expense categories to more accurately reflect your family’s lifestyle but I tried to include a diverse list of expenses to give you an idea of what to account for. If you’re totally clueless on what you’re spending on or even how much you spend on basic things like groceries, I suggest you try a 30-day trial period where you diligently track each and every expense. This will help acquaint you with your spending habits and allow you to identify practices that are not budget-friendly. For example, if your grocery expense is much higher than you’re comfortable with and you’d really like to be saving for say a post-graduation trip then you might want to adopt practices like meal planning and meal prepping to work alongside your budgeting approach. While you do want to be as accurate as possible when accounting for your spending, you don’t want to be too extreme to the point that you’re tracking every penny unless you are in a very tight situation. Once you’ve figured out you’re spending habits, created a budget, and have begun tracking your monthly expenses you are now able to do the fun part of analyzing your data and working towards saving and investing.

Now with the basics down, it will be much easier for me to share some of my tips and tricks for saving monthly, planning trips, and investing in the future. I have a few posts planned out for this series already; one to cover college savings funds and another to cover the advantages of memberships like Amazon Prime and Costco. As I said early on in this post, finance is a subject that I am very passionate about so if there’s something you’d like to see covered in this series then please don’t hesitate to contact us either through email or by leaving a message in the comments below. We hope this post was the spark you needed to rethink your budget and saving strategies for 2018. As always, if you liked this post please follow us and share!

Pingback: Family Finance: Why Amazon Prime?